Forex Trading During Global Economic Crises: A Guide to Navigating the Storm

Let’s be honest—global economic crises are terrifying. Headlines scream about market crashes, soaring inflation, and geopolitical turmoil. For most, the instinct is to retreat, to hide cash under the proverbial mattress. But for forex traders, these periods of intense volatility are… different. They’re not just a threat; they’re a landscape reshaped, a market operating at its most raw and revealing.

Trading forex during a crisis is like sailing in a hurricane. The risks are monumental, sure. But for those who understand the winds and currents, who have a sturdy boat and a clear plan, it’s also where significant opportunities can emerge. The key isn’t bravery; it’s preparation, perspective, and a hefty dose of respect for the market’s power.

Why Forex Markets React So Violently to Crises

Forex, at its core, is a measure of relative economic strength. When a global crisis hits, it forces a brutal and rapid reassessment of every country’s economic prospects. It’s a classic flight to safety, but with complex layers.

Currencies don’t exist in a vacuum. They’re judged against each other. So, when panic sets in, capital floods into what are perceived as safe-haven currencies. The US Dollar (USD), Swiss Franc (CHF), and Japanese Yen (JPY) often strengthen in these moments. Why? Because of deep, liquid markets, political stability, and, in the case of the JPY, a history of low yields that can actually rise during turmoil.

Conversely, currencies from economies heavily reliant on commodity exports or with large external debts can get hammered. Think of the Australian Dollar (AUD) or the South African Rand (ZAR) during a growth scare. The market’s mood swings from “risk-on” to “risk-off” with whiplash speed.

The Double-Edged Sword: Volatility and Liquidity

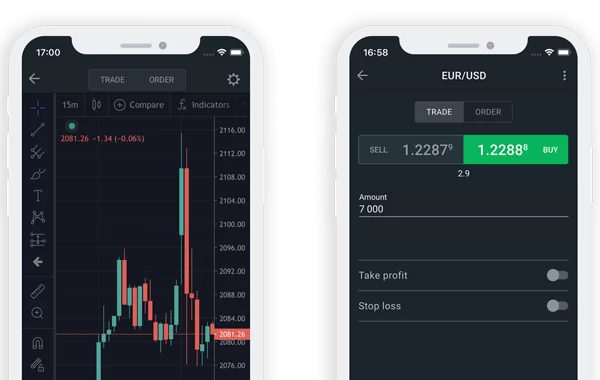

Here’s the deal: volatility spikes. Price movements that normally take weeks can happen in hours. This creates obvious opportunities for profit, but it also magnifies losses just as quickly. Spreads—the difference between the buy and sell price—can widen dramatically, especially on exotic pairs, increasing your cost to enter and exit trades.

Liquidity, however, is a funny thing. In the major pairs like EUR/USD or GBP/USD, it generally remains high. But it can dry up in less-traded pairs or at specific times, leading to what traders call “slippage”—where your order is filled at a worse price than you expected. During the 2020 pandemic flash, we saw this in action, with even major pairs experiencing wild, momentary gaps.

Practical Strategies for Crisis Trading

Okay, so the world’s on fire. What do you actually do? Blindly chasing price is a recipe for disaster. You need a framework.

1. Follow the Central Bank Script (It’s Everything)

During crises, central banks become the main characters in the story. Their actions—interest rate decisions, emergency lending, quantitative easing—directly drive currency values. A hawkish central bank fighting inflation might support a currency, while one flooding the system with liquidity might weaken it.

Your job is to interpret their forward guidance. Listen to every word from the Fed, the ECB, the BOJ. The nuance is where the trades are.

2. Simplify Your Pairs

This isn’t the time to get cute with exotic crosses. Stick to the major and minor pairs where liquidity is deepest. The EUR/USD, for instance, becomes a pure play on the relative economic outlook and policy divergence between the Eurozone and the United States. Fewer variables to track means a clearer picture.

3. Risk Management is Your Lifeline

I can’t stress this enough. Your usual risk parameters might not be enough. Consider:

- Reducing position size: If you normally risk 1% per trade, maybe go down to 0.5%. Volatility means your stop-losses are more likely to be hit.

- Widening stop-losses (strategically): To avoid being stopped out by normal crisis-era noise, place stops beyond key technical levels. But—and this is crucial—reduce your position size to compensate. You’re giving the trade more room to breathe without risking more capital.

- Using tighter take-profit levels: In chaotic markets, grabbing smaller, more frequent profits can be a valid survival tactic. The trend might not ride as far as you hope.

Honestly, preserving capital isn’t a boring rule during a crisis; it’s the entire game. The goal is to stay in the game long enough to capitalize when clarity returns.

Psychological Pitfalls: The Enemy Within

The market will test you. Fear and greed are amplified. You might feel the urge to “revenge trade” after a loss, or to go “all in” on what feels like a sure thing. This is where most traders blow up.

You have to become a student of your own emotions. Set your rules before the trading session and stick to them like glue. Take breaks from the screen—the constant red and green can hypnotize you into bad decisions. And maybe, sometimes, the best trade is no trade at all. Sitting on the sidelines in cash is a legitimate position during the most unreadable phases of a crisis.

A Glimpse at Recent History: What We Learned

Looking back helps. The 2008 Financial Crisis saw the USD initially surge, then wobble as the Fed cut rates, only to strengthen again as the global firestorm intensified. The Euro plunged under sovereign debt fears a few years later.

The COVID-19 pandemic was a masterclass in crisis reaction. The initial “dash for cash” saw a massive, broad-based USD spike. Then, as the Fed unleashed unprecedented stimulus and risk assets recovered, the dollar trended lower for months. It was a two-act play, and traders who adapted to the shifting narrative prospered.

| Crisis Event | Key Currency Move | Primary Driver |

| 2008 Financial Crisis | USD Strengthened (overall) | Flight to safety, global demand for dollars |

| 2010-2012 Eurozone Debt Crisis | EUR Weakened (vs. CHF & USD) | Contagion fear, political instability within EU |

| 2020 COVID-19 Pandemic | USD Spiked then Trended Lower | Initial liquidity scramble, then historic monetary easing |

| 2022 Russia-Ukraine War | EUR Weakened, CHF & USD Strengthened | Proximity to conflict, energy security fears |

Each crisis has its own fingerprint, but the patterns of flight, policy response, and eventual rebalancing repeat.

Final Thoughts: The Trader’s Mindset

Trading forex during a global economic crisis isn’t for the faint of heart. But it also strips away the noise and reveals the fundamental forces that always drive currencies: fear, policy, and relative strength. It demands more from you—more discipline, more humility, more focus on the long-term process over short-term outcomes.

In the end, the traders who navigate these storms best are the ones who see themselves not as predictors of chaos, but as prepared responders to it. They have a plan for when the winds shift, and the emotional fortitude to follow it, even when every headline screams to do the opposite. That’s the real edge. Not a secret indicator, but a resilient, adaptable approach to a market in flux.