Free Share Trading Platforms

Those of you who want to invest in shares for the first time should consider using a free share trading platform. These programs can be very beneficial if you’re a beginner investor or don’t have a lot of money to spend. They typically charge no annual fees or administration fees. Furthermore, you can get a free share worth between PS3 and PS200 by signing up for the Money to the Masses program. But remember that share trading remains a risky business. It’s still important to diversify your portfolio with a variety of assets.

Using a free share trading platform is not without risks. First of all, the broker’s fee will depend on the type of trading you want to do. There are several ways to trade stocks for free, and not every app is suitable for every investor. In addition to commission-free trading, these platforms often charge a one-off fixed fee for account holding or trades. Freetrade, for example, offers commission-free stock trading for up to 6,000 US and UK stocks. Moreover, new users get PS50 bonus when they sign up with Freetrade, and a PS1 bonus every 6 months after they join.

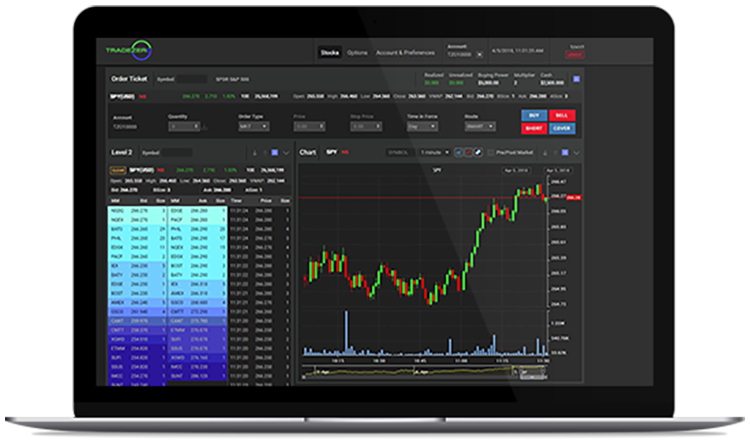

Some people have reported a lack of research tools when using Freetrade, but that doesn’t mean they shouldn’t use these services. Freetrade offers graphs of historical share prices and provides basic market information. Its blogs and forums are full of useful information, including tips on trading in shares. While free share trading does come with some risks, the benefits outweigh any disadvantages. Once you learn about the risks and rewards of these platforms, you can use them to your advantage.

While free share trading offers many advantages, it is still crucial to use a sound risk management strategy. Many top traders use the “one percent rule” in order to limit their potential losses and protect their portfolios during volatile times. In addition, it is important to be aware of the spread on shares, as this will make the difference between an excellent deal and an excellent one. If you can’t afford to pay the spread, it’s probably best to choose a paid option.

While most free share trading platforms offer free deposits and withdrawals, some are paid-for services. For example, Freetrade doesn’t offer margin trading, which means that you borrow funds to buy and sell stocks. Moreover, some of these free platforms may require an annual subscription fee. In addition, the platforms may only support certain payment methods, such as credit card and debit card transactions. This is an added risk that most people may find difficult to overcome.

The price of a share is governed by the bid-offer spread. The spread refers to the difference between the highest and lowest price of a share. When a share trades for more than its lowest price, the buyer will pay more than the seller. The size of this gap depends on how liquid the share is and its liquidity. In general, companies with higher liquidity will have tighter spreads. Also, remember that the mid-price of a share is different from its low-price.