You Won’t Believe How Cross-Currency Pairs Can Revolutionize Your Forex Trading!

The foreign exchange market, or forex market, is the largest and most liquid financial market in the world, with a daily trading volume of over $6.6 trillion. While many traders are familiar with major currency pairs that include the US dollar (USD), there is a whole other world of trading opportunities in trading cross-currency pairs. This guide will provide a comprehensive overview of cross-currency pairs, from the basics of forex trading to advanced strategies for trading these unique pairs. This material is for informational purposes only and does not constitute investment advice.

Introduction to Forex Trading

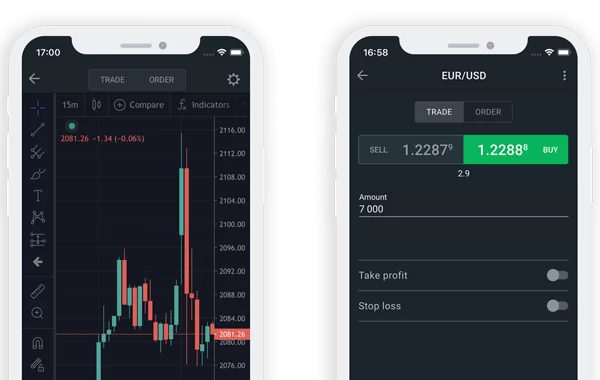

Forex trading is the act of buying and selling currencies on the foreign exchange market with the goal of making a profit. Currencies are always traded in pairs, and the value of one currency is quoted in relation to another. For example, in the EUR/USD pair, the value of the euro (EUR) is quoted against the US dollar. Forex traders speculate on the fluctuations in these exchange rates. The forex market is open 24 hours a day, five days a week, offering ample opportunities for traders to participate. To begin to trade forex, an individual needs to open an account with a reputable trading platform.

Currency Pairs

In the forex market, currencies are quoted in pairs. A currency pair consists of a base currency and a quote currency. The base currency is the first currency in the pair, and the quote currency is the second. The exchange rate of a currency pair indicates how much of the quote currency is needed to purchase one unit of the base currency. For example, if the EUR/GBP exchange rate is 0.85, it means that one euro can be exchanged for 0.85 British pounds.

There are three main categories of currency pairs:

- Major Pairs: These are the most traded currency pairs in the forex market and always include the US dollar. Examples of major pairs include EUR/USD, USD/JPY, and GBP/USD. These pairs have high liquidity and tight spreads.

- Minor Pairs (Cross-Currency Pairs): These currency pairs do not include the US dollar. Examples of common cross-currency pairs include EUR/GBP, EUR/JPY, and GBP/JPY.

- Exotic Pairs: These pairs consist of one major currency and one currency from an emerging or smaller economy. An example is the USD/TRY (US dollar/Turkish Lira). These pairs typically have lower liquidity and wider spreads.

Cross Currency Transactions

Historically, if an individual wanted to exchange two non-USD currencies, they would first have to convert one currency to the US dollar and then convert the US dollar to the desired currency. This two-step process was a result of the Bretton Woods agreement after the Second World War, which established the US dollar as the world’s primary reserve currency, pegged to gold. This system made cross currency transactions cumbersome and more expensive.

However, with the end of the gold standard and the growth of the global forex market, direct cross currency transactions are now commonplace. This means you can directly exchange currencies like the euro for the Japanese yen without involving the US dollar. These single-step cross currency transactions have made international payments and trading more efficient and less costly, as traders only need to cross one spread.

Cross Currency Pair Trading

Trading cross-currency pairs, also known as cross pairs, offers forex traders an alternative to trading the major pairs. By trading cross-currency pairs, traders can take positions on the relative strength of two economies without being directly exposed to the volatility of the US dollar. For example, a trader who believes the Eurozone economy will outperform the UK economy can trade the EUR/GBP pair directly.

There are several strategies for trading cross-currency pairs:

- Carry Trade: This strategy involves buying a currency with a high interest rate and selling a currency with a low interest rate. The aim is to profit from the interest rate differential. The AUD/JPY and NZD/JPY are popular pairs for this strategy.

- Hedging: Cross-currency pairs can be used to hedge against the risk of an existing position. For example, a trader with a long position in USD/JPY and a short position in EUR/USD is effectively long the EUR/JPY.

- Fundamental Analysis: This involves analyzing economic data and news events to predict the future direction of a currency pair. For example, a trader might analyze the monetary policy of the European Central Bank and the Bank of England to trade the EUR/GBP.

Understanding Cross Currency

Understanding the dynamics of cross-currency pairs is crucial for successful trading. The value of a cross-currency pair is derived from the exchange rates of the two currencies against a common currency, usually the US dollar. For example, the EUR/JPY exchange rate is derived from the EUR/USD and USD/JPY exchange rates. Most trading platforms now calculate this automatically for traders.

Here are some of the most popular cross-currency pairs:

- EUR/JPY: The euro against the Japanese yen.

- EUR/GBP: The euro against the British pound.

- EUR/CHF: The euro against the Swiss franc.

- GBP/JPY: The British pound against the Japanese yen.

- AUD/NZD: The Australian dollar against the New Zealand dollar.

The Role of Base Currency

In any currency pair, the first currency is the base currency. The base currency is the currency against which the exchange rate is quoted. When you buy a currency pair, you are buying the base currency and selling the quote currency. Conversely, when you sell a currency pair, you are selling the base currency and buying the quote currency.

For example, in the EUR/GBP currency pair, the euro is the base currency. If you buy the EUR/GBP, you are buying euros and selling British pounds. The value of the base currency is always one unit. The exchange rate tells you how much of the quote currency is needed to buy one unit of the base currency. Understanding the role of the base currency is fundamental to understanding how to trade forex pairs.

Conclusion on Cross Pair Trading and Forex Trading

Cross-currency pair trading offers a wealth of opportunities for forex traders. By diversifying away from the US dollar, traders can gain exposure to different economies and take advantage of a wider range of trading setups. While cross-currency pairs can have lower liquidity and wider spreads than major pairs, they can also offer cleaner trends and less noise, which can be beneficial for some trading strategies. As with any form of trading, it is essential to have a solid understanding of the market and a robust risk management plan. The information provided here is for educational purposes and should not be considered investment advice.