Forex Trading 101 – A Comprehensive Beginner’s Guide

Forex trading can be a highly risky endeavor and may lead to substantial financial losses. Therefore, it’s essential that before beginning Forex trading you properly educate yourself and create an action plan.

As with any profession, learning to trade Forex profitably takes dedication and hard work. This guide is here to assist with that journey – covering everything from beginner level topics such as Market analysis and Strategy formation all the way up to advanced topics including Market analysis and Trading strategies.

Basics

The forex market is an international exchange for trading currencies. Traders use it to speculate on future movements of national currencies or hedge against exchange risk. Currencies are traded against one another as pairs – this signifies their relative values between nations.

Line charts are the go-to option for forex traders looking to identify long-term trends in currency prices and form the basis of further technical analysis.

Market analysis

Market analysis is a method used to research various factors influencing a market, including competitors, customer behavior and trends. With this information at their disposal, businesses can use market analysis to shape strategies and create marketing plans that help ensure their business’ success.

Market analysis requires data on market volume and value; volume measuring total sales while value represents annual monetary sales volume of products or services sold per year.

An extensive market analysis is an integral component of any business plan, whether written for internal purposes or presented to lenders. Be sure to keep the results of your research organized and easily accessible so they can be referenced whenever needed.

Trading strategies

Conducting market analysis and choosing an effective trading strategy are the keys to making profits in forex trading. Each strategy comes with its own specific set of requirements that should fit with an individual trader’s goals and resources – popular options include range trading, trend trading, day trading, scalping and position trading.

Traders can choose a stop loss level, which is the predetermined price below which they will close a trade, as well as leverage to increase initial investments and take larger positions. Remembering the risks inherent to leverage magnify both profits and losses equally – therefore monitoring risk tolerance to ensure you feel comfortable taking on this amount of risk is of vital importance.

Trading platforms

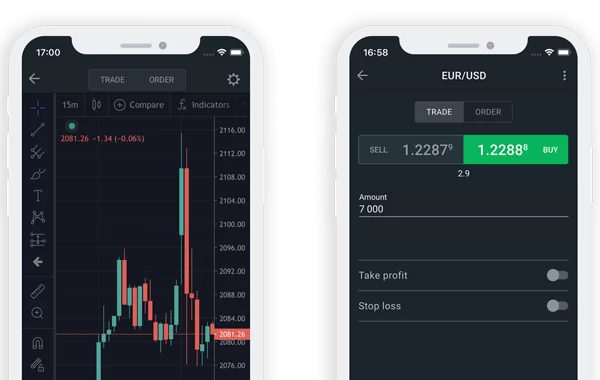

Trading platforms are software systems designed to enable investors and traders to purchase or sell financial products online without the assistance of brokers, as well as provide data tools, charting software, educational resources and educational support resources that assist in making trading decisions.

Selecting an effective trading platform is essential to online trading success. Your choice should reflect your investment style, financial goals, level of experience and have adequate security features to protect your personal information.

There are three primary types of trading platforms: desktop, web-based and mobile. While PC software provides the most extensive features of functionality for trading platforms installed as desktop software, web-based and mobile platforms allow access from any computer with stable internet connection to provide trading access from anywhere at any time.

Leverage

Leverage allows forex traders to increase their exposure by borrowing capital to leverage a larger position with smaller deposits on the forex market, magnifying profits and losses based on full value of position rather than initial investment alone.

As with a house loan, leverage trading can magnify losses exponentially. Therefore, new traders should use leverage with caution and never invest more than they can afford to lose; generally speaking, your maximum loss should not exceed 3% of total trading capital.

Trading currencies

Forex trading involves purchasing and selling currency pairs in an attempt to make a profit, making up part of an international market with traders from all corners of the world. To begin trading forex, one must open a brokerage account and develop a trading strategy.

Currency trading can be an exciting and profitable venture. To minimise risks and stay informed about potential geopolitical effects on markets, always use a regulated broker and keep trading capital separate from other assets – never risk more than you can afford to lose!