Can I Trade Forex Without a Broker?

If you are wondering, can I trade forex without a broker? Well, the short answer is no. Unless you’re a high-roller or a wealthy individual, forex trading isn’t for you. You need a broker to protect your interests and help you trade profitably. In addition, you should avoid the high spreads, which can prevent you from buying or selling at a price you desire.

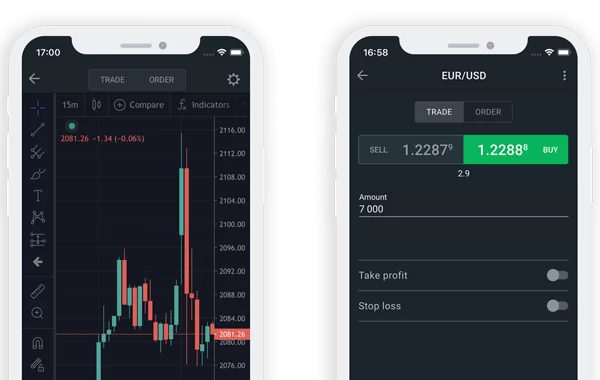

To trade foreign currency, you must have a reliable internet connection. Your broker will transfer your orders to the liquidity provider to ensure you get the best price. Once your order is received and processed, it’s transmitted through the ECN system and executed at the best possible price. If you’re a retail trader, you should obtain access to the market through an electronic trading platform. A trading platform will let you load real-time quotes and analyze the market situation. You can also send orders to buy/sell currencies at current market prices.

Trading without a broker has its pros and cons. Trading without a broker would limit you to only major pairs with horrible exchange rates. Also, without a broker, you’d be limited to margin trading, which can easily make you a hostage to leverage. Without proper control over leverage, you could lose your deposit immediately. Another major problem is that fraudulent brokerage firms often manipulate the price charts, deposit amounts, and client trades.

The best way to find a reliable Forex broker is to use a regulated broker. The National Futures Association is the regulatory body for forex brokers in the U.S., and their members must meet strict guidelines or be subject to disciplinary action. While regulated brokers are a safer bet, you should also avoid offshore brokers or unregulated firms. You should always look for NFA members in the list of recommended brokers, as this will give you the necessary background information to choose a reputable broker.

One of the first steps you should take to trade forex is to learn about the various types of trading platforms available. Some brokers will offer you free demo accounts, so you can compare their features and fees before deciding on which one to use. Some of the best forex brokers even offer fixed spreads. This means that you won’t have to worry about your trades reacting to market conditions and will give you the best prices every time.

When choosing a broker, you must decide what type of trading platform you want. MetaTrader 4 is the most popular third-party trading platform, while cTrader is another popular option. Some brokers even build proprietary trading platforms for their clients. Make sure the software you choose is reliable and compatible with your computer. A good forex broker should also offer a customer support team and add-ons. In terms of software, MetaTrader 4 has been a trusted leader for forex trading platforms.

Most reputable forex brokers offer demo accounts. These allow prospective clients to practice trading without the need for a broker. Using these accounts, you can try out the different trading systems before you fully commit to one. There are also several educational resources available on their websites, including webinars about the forex market. They even provide information about different currency pairs and periodic events. All this information will help you choose the best trading platform and start generating profit and revenue for yourself.