What is Forex Trading?

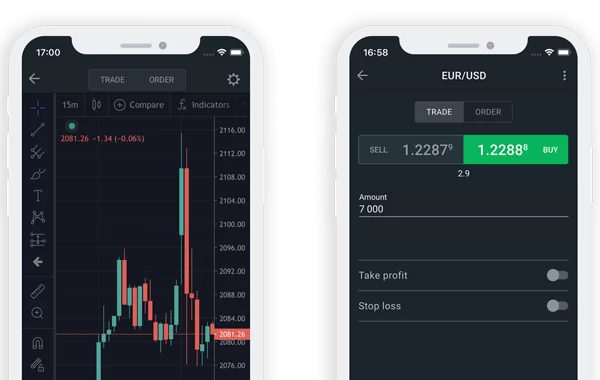

Forex trading is a form of international money trading. It uses the concept of leverage to help traders trade positions with small amounts of capital. The difference between the bid and ask prices is known as the spread. This allows traders to speculate on the market’s movements by buying or selling currencies. One way to use leverage is to trade currencies in pairs. One currency is called the base currency while the other is called the quote currency.

The price of currencies varies according to macroeconomic events and country-specific factors. Currency traders keep an economic calendar to stay on top of important economic releases. Interest rates are a major driver of currency prices. Changing interest rates can affect a currency’s value and make it less attractive for foreign investors. A weak dollar makes it more expensive to import goods and travel abroad. This can be advantageous to export-oriented companies.

Currency trading is a global industry where people of different countries can invest. By correctly choosing when to buy and sell, currency traders can profit. Before using the forex market, people could only travel internationally by purchasing their own currency. Often times, the only way to do this was to find a currency exchange booth at an airport or another convenient location. Then, they would exchange the currency in their wallet to the local currency.

The forex market is open around the clock. The US dollar, EU Euro, Japanese Yen, and British Pound Sterling are the most common currencies traded in the market. The currency exchange market operates in nearly every time zone and is decentralized, which makes it possible to trade at anytime of the day or night. This makes forex trading possible even if you don’t live in a developed country.

The forex market has three main markets: the spot market, the forward market, and the futures market. The spot market is where currencies are bought and sold immediately, and the forward and futures market are where currencies are bought and sold at a set exchange rate. In order to use forex, you have to invest in at least one currency pair, so you can use it in multiple ways.

While forex trading has several advantages over other forms of currency trading, it also has a few drawbacks. Traders who aren’t accustomed to large lot sizes are put off from the market. Leverage allows traders to take larger positions without putting up large amounts of capital. Because leverage allows you to use a smaller amount of money, you can trade larger amounts of currency. You should always be aware of the risks associated with forex trading and understand your risk tolerance before deciding to engage in it.

Forex trading is similar to buying and selling stocks, except that you are dealing in currency pairs, not single currency. As a result, the market is highly geared, and even a small change in one currency can impact the price of another currency. Forex is a popular method of international financial trading, and you can learn more about it here.