Can You Trade Forex on Weekends?

Forex markets are among the world’s most liquid, providing traders with an exceptional opportunity to make money. Unfortunately, many traders hesitate to trade on weekends due to limited trading hours.

Mercifully, some brokers offer weekend trading for certain currency pairs. In this article we’ll investigate this trend and the risks and rewards involved with trading during this timeframe.

Risks

Forex trading is an engaging investment activity. But is weekend forex trading appropriate? Unfortunately not – as banks and institutional traders who account for 93% of market volume only operate during weekdays.

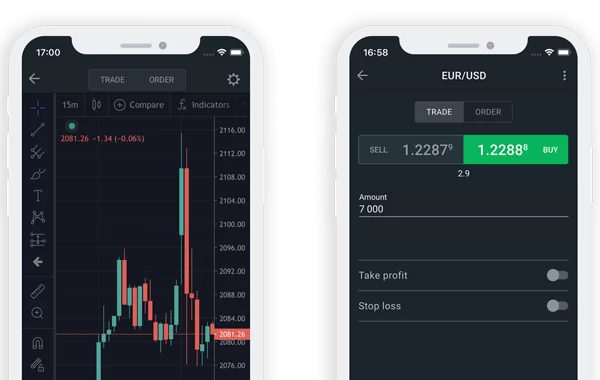

Although many brokers offer weekend trading, it’s essential to be aware of its associated risks. These include lower liquidity and wider spreads that lead to higher transaction costs as well as gaps in price fluctuations that make predicting price movements difficult.

To reduce risk and maximize profits, it is wise to employ stop loss orders and take profits quickly when price reaches your profit target. This helps avoid significant losses if market gaps shift against you – an approach particularly suitable for gap traders who employ gap trading strategies; traders should also keep an eye out for any news events which could affect weekend market movements.

Liquidity

Though high net worth individuals with large trading accounts may be able to negotiate weekend trades with their brokers, doing so is rarely advised as trading at this time requires extensive research and analysis as markets don’t typically trade so actively during these weekends. Furthermore, traders will need to devise a strategy tailored specifically for them before embarking on this venture.

Some brokers allow traders to trade certain assets over the weekend, such as indices and cryptocurrencies. This can be advantageous for traders looking to protect open weekday positions should an economic event trigger negative volatility.

However, liquidity in these markets tends to decrease significantly over the weekend due to large institutional forex traders and banks not operating at full capacity. This leads to wider spreads and challenging trading conditions – making it harder for traders to speculate on price movements profitably.

Brokers that offer weekend trading

There are a handful of brokers that offer weekend trading, but it is essential that you conduct adequate research. Many charge higher spreads and liquidity is low compared to weekdays; plus trading over weekends may not fit with your body clock.

Weekend forex gaps can be extremely profitable if approached correctly. When selecting the currency pair to trade, make sure it has high liquidity and widely traded markets, as well as ensure its risk-to-reward ratio is appropriate.

Limit your position sizes when employing a scalping strategy to protect yourself against losses and safeguard your capital. Staying up-to-date on global news to anticipate any possible shifts in the market. Finally, close any trades too close to their stop loss orders before weekend close if possible to minimize chances of being stopped out by a stop loss order.

Trading during the weekend

Forex trading on weekends can be both exciting and profitable for traders who employ an effective risk management strategy. The ideal markets to trade are those open around the world with high volume trades; additionally, traders should stay apprised of any economic news or market events which might alter currency prices by reading market reports such as Commitment of Traders report.

Additionally, traders should avoid engaging in speculative trading as it is highly risky and not suitable for all traders. Furthermore, traders should keep in mind that trading during weekends may result in greater losses due to reduced liquidity and wider spreads; it would therefore be wiser to use this time for research or manual backtesting purposes, or making plans for the week ahead – particularly as many brokers only provide limited instruments at this time of the week. Indices, commodities, and cryptocurrencies tend to be popular options for weekend trading sessions.