How to Choose Forex Trading Platforms

A Forex trading platform is an application interface offered by currency brokerages to their clients to provide them access to the Forex market as virtual traders. The main objective of these platforms is to facilitate easy entry and exit to help ensure a seamless transition from one position to the other, but this ease of access also has its limitations as many users find that the platform they use does not suit their style of investing or trading and consequently they exit the market in frustration and disappointment.

Many people start out using Forex platforms because of its ease of use. The platform can be used by anyone who has the appropriate knowledge of how the market works. However, users often find that the platform they are using does not offer enough functionality in order to meet their trading needs. There are many types of trading platforms including those that specialize in different aspects of the market such as spot trading and scalping, as well as ones that offer more general Forex functionality, such as support for multiple accounts and live trading.

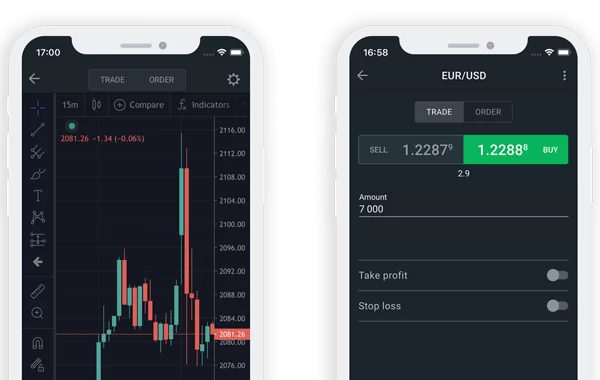

Some users do not find the platform that they are using suitable for their trading styles and hence they may decide to switch platforms. The platform should therefore provide adequate trading information to enable the user to make informed decisions about where to invest, as well as a range of tools to make the trading process easier and less time consuming. Some trading platforms also have additional features that allow users to place limit orders on the market. These additional features may include indicators and charts, which can give traders an indication of when to enter and exit a position, and may also provide alerts when market conditions change.

If you are investing in the Forex market, then it is important to choose a platform that suits your investment style. You will need to determine the extent to which you trade by the size of your profits as well as the amount of money you are willing to lose. For example, if you are a small time investor then you are more likely to want a platform that provides you with a trading signal service and has a simple interface and provides you with basic statistics, while if you have some experience in the currency markets, then you are more likely to require a more robust platform that has advanced analysis tools, real-time data and has a trading signal service.

Some Forex trading platforms are more suited to certain trading styles than others and the platform should therefore offer a user interface that is easy to use for all investors. This should also provide traders with plenty of trading information including trading signal, news about current market conditions and market news so that can be easily followed in order to make informed trading decisions. Some Forex trading platforms are open source and therefore allow traders to view the information that they need to make informed trading decisions in a simple and intuitive way, while others are closed source and so if the market is closed at the time that is most important for you then you will need to select a closed source platform that you will be unable to follow any market updates.

When choosing a Forex platform, ensure that it can support multiple accounts, provide live trading signals and provides you with a wide range of trading statistics and charts that can be accessed on the internet or by email, so that you can track the status of the market. It should also be easy to set up a trading signal and provide you with a trading account, which allows you to sign up with a number of accounts from different brokers without being required to manually sign in to each account.