Choppy Forex Market, How To Trade It

You hear it all the time, “Choppy Forex Market, How To Trade It” (which by the way is not a phrase anyone would ever say if he was serious about making money in the Forex markets). I’m not trying to belittle the desire to learn how to trade this dynamic and ever changing market, but it’s quite simple to become a chump when you aren’t aware of your mistakes and don’t have the discipline to avoid making them. It’s the nature of the beast that makes it so hard for traders to be successful.

With nearly 20 years of trading forex, and literally five years as a personal coach and mentor, I’ve found that many newbie traders expect to make money on every trade they make in the FX markets and place only four or five trades per day. Most of these “Choppy Forex Market” traders’ expectations are way out of line with Forex reality, volatility and liquidity of the markets. You can get in over your head and have no idea where you stand at any given moment in the trading cycle, but that’s OK. What’s not OK is expecting to earn big in a trading system, because it has been optimized to automatically “make money for you”.

Forex markets are highly volatile, you can lose a lot of money overnight and it doesn’t matter how much Forex training you’ve done, you will still be losing money. You want to be able to get in and out of a trade with relative ease, so that you know where you’re at all times and you don’t risk losing your capital. It’s this ability to exit trades quickly that is so important in the FX markets.

If you’re looking to get into the choppy Forex market, how to trade it, I recommend that you focus more on developing the discipline to stick to your trading plan and stop and start your trading in an orderly fashion. Don’t ever expect to make money overnight, but rather plan for your losses and plan to be able to make money in a trading program that can support your strategy.

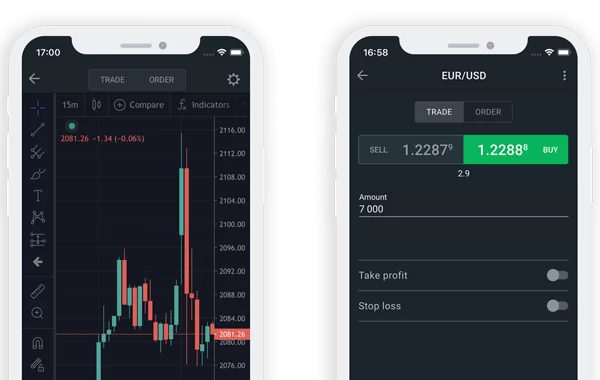

There is a reason the majority of Forex traders are losing money. They are trying to win money in their trading software instead of winning it in their own Forex trading programs. A trading program that allows you to trade multiple trades but won’t allow you to exit your trades on time or plan ahead for the market conditions is not an effective Forex trading system. The only way to successfully trade the FX markets is to do everything yourself. You need to be able to trade on autopilot and have your own automated trading software that will handle your trades for you.

I know it can seem overwhelming, especially for someone just starting out in the markets, but trust me it’s not. It’s not hard to do and there are many successful people out there who have done so using the trading software I use. All you really need to do is set up a mini trading account with an online Forex broker and learn the basics of Forex trading, once you’re able to do that you can then use an actual trading account that works for you.