How to Learn About Foreign Currency Transactions

International Currency Notes

A Foreign currency transaction is required if a company undertakes an online accounting transaction where a currency other than the reporting currency is involved. For example the company may import goods from countries other than its reporting country, giving rise to import accounts receivable and expense accounts payable in another currency, or it may purchase exported goods from other countries giving rise to export accounts receivable and expense accounts payable in another currency.

There are two main types of foreign exchange, one is the Interbank market and the other is the Over the Counter (OTC) market. The Interbank market is based on the fact that there are many banks that maintain trading accounts for customers and they usually exchange their currencies between the US Dollar and any of the currencies they maintain trading accounts with on a daily basis. This means that a customer will be able to trade currency between the two currencies they have on account in one of the banks and this will give them access to the most liquidity in the markets. The market for OTC currencies is open twenty-four hours a day which means that the OTC market is open on all days and nights excepting Sunday.

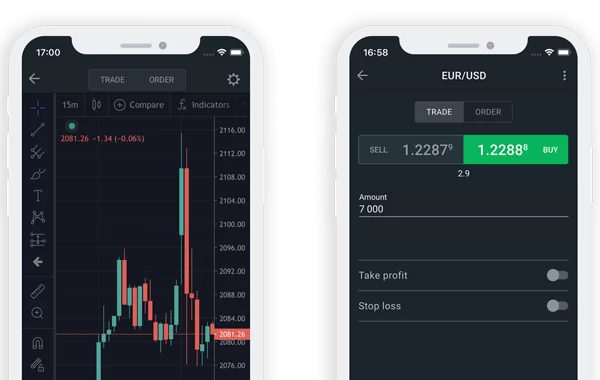

The Forex market works differently. Instead of being based on the fact that there are many banks that provide trading facilities for their customers, the Forex market is based on the fact that there are many brokers that provide their clients with the capacity to enter into a market on the internet. The broker will take a commission on any trades that his client makes but will charge a fee for each currency that is traded. The price of the currencies traded is then based on the difference in the price of the currency being traded and the price of the currency being quoted by the broker.

When you are dealing with foreign currencies, it is important that you learn how to work with the currency markets in the best way possible. One of the most important things is knowing which currencies to use when trading. You should never trade more than you can afford to lose and the currency you use should never fall to more than a certain amount before the price moves back up again. You also need to understand the various markets that exist on the internet and what each one represents and when it is the best time to use it.

One of the best ways to get your feet wet with the Forex markets is to sign up with a broker. Most brokers offer free demo account so that you can get a feel for the type of market you want to trade in. You can either test Forex online or you can trade your Forex account for free before actually joining the Forex market. As you gain experience, you will probably want to consider using a broker that offers more than just free demo accounts.

Forex brokers have access to a number of Forex trading systems that will allow you to learn the ins and outs of the market without having to risk your money at all. They also have the ability to place your trades for you and they can provide you with reports about your overall results and the positions you have placed. These reports should be used in conjunction with the information you have learned from your Forex training.